santa clara county property tax collector

View and pay for your property tax billsstatements in Santa Clara County online using this service. Send us a question or make a comment.

California Public Records Public Records California Public

What information do I have to give to you before I can access the data.

. An escape assessment is a correction to a personal propertys assessed value that the Assessors Office of the County of Santa Clara did not add to any prior years Annual Unsecured Property Tax Bill. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. Closed on County Holidays.

150 Santa Cruz CA 95060 Phone. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. Last Payment accepted at 445 pm Phone Hours.

The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. MondayFriday 900 am400 pm. Learn why Santa Clara County was ranked a top 40 Healthiest Community by US.

Participants include Assessor Larry Stone Board of Equalization Member Malia M. Cohen Nora Galvez a member of the Santa Clara County assessors senior management team and one of the States leading assessment experts on transfers and Board of Equalization Tax Counsel Richard MoonThe session will be moderated by Ellen McKissock co-chair of Hopkins. Santa Clara County Property Tax Assessor The Santa Clara County Tax Assessor is responsible for assessing the fair market value of properties within Santa Clara County and determining the property tax rate that will apply.

When contacting Santa Clara County about your property taxes make sure that you are contacting the correct office. Proposition 13 - Article 13A Section 2 enacted in 1978 forms the basis for the current property tax laws. The Tax Assessors office can also provide property tax history or property tax records for a property.

Currently you may research and print assessment information for individual parcels free of charge. Doing Business As. These escape bills are usually the result of a taxable event that escaped the Office of the Assessor.

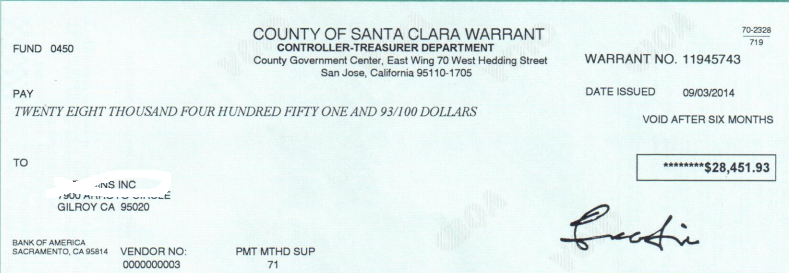

Thankfully the Santa Clara tax collectors office has entered the 21st centuryafter all Silicon Valley is within its jurisdictionand you can pay your property taxes online. Currently you may research and print assessment information for individual parcels free of charge. County Government Center 701 Ocean Street Rm.

Making Payments Online. Santa Clara County Assessor 70 West Hedding St. 12345678 Enter Account Number.

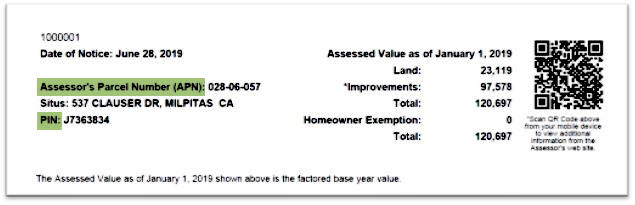

You can pay tax bills for your secured property homes buildings lands as well as unsecured property businesses boats airplanes. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. See detailed property tax information from the sample report for 3121 Oakgate Way Santa Clara County CA.

Twitter Santa Clara County The Office Of Assessor. San Jose CA 95110. Enter Property Address this is not your billing address.

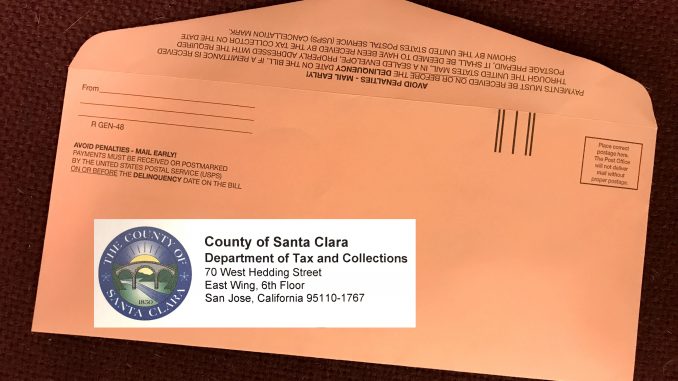

MondayFriday 800 am 500 pm. Pay your 2nd installment by April 11th to avoid penalties and fees eCheck payment is free. Enter Property Parcel Number APN.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. You can get the information from the Assessors Office located at 70 West Hedding Street San Jose East Wing 5th Floor Monday through Friday between the hours of 800 am. If you have documents to send you can fax them to.

Property taxes are levied on land improvements and business personal property. To pay Property taxes for Secured property you will need your Assessors Parcel Number APN or property address. News and World Report.

Select Alley Avenue Blvd Circle Commons Court Drive Expressway Highway Lane Loop Parkway Place Road Square. These property tax records are excellent sources of. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

You can call the Santa Clara County Tax Assessors Office for assistance at 408-299-5500. Enter Property Address this is not your billing address.

Santa Clara County Ca Property Tax Search And Records Propertyshark

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Four Major Santa Clara Developments To Watch In 2020 San Jose Spotlight

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara County Assessor Accuses Candidate Of Hacking Him

Santa Clara County Property Tax Getjerry Com

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Open Competitive Job Opportunities Sorted By Job Title Ascending County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara Shannon Snyder Cpas

Santa Clara County Second Installment Of Property Taxes Due By April 11 Ke Andrews

Scam Alert County Of Santa Clara California Facebook

A Cricket Stadium Is Being Proposed At This Silicon Valley Site

Santa Clara County Tax Collector 13 Photos 22 Reviews Public Services Government 70 W Hedding St San Jose Ca Phone Number Yelp

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post